Economic and Financial Market Outlook Q1 2026

Global Economy: A Familiar Feeling

2025 marked the third consecutive year of solid global economic growth and strong equity market gains. Many of the trends which supported these positive results have considerable momentum, and we think they will extend well into this year. We expect global growth to continue to expand at its recent pace, with the United States well-positioned for above-trend performance. We are slightly more optimistic than the International Monetary Fund’s October 2025 World Economic Outlook, which projects 2026 global GDP growth of 3.1%, a similar advance to the prior two years. This moderate, but steady growth will be reinforced by policy in many of the major global economies: the US, European Union, and China are pursuing easier monetary conditions and fiscal stimulus to start 2026. A key uncertainty is whether these accommodative policies will persist as budgets, politics, and markets look ahead to changing conditions in 2027. While US inflation will likely stay higher than the Federal Reserve’s 2.0% target, we anticipate relative stability of 2.5% - 3.0% without unsettling spikes. With satisfactory economic growth, strong corporate earnings, palatable progress on inflation, and supportive fiscal and monetary stimulus, our base case is for another year of stock market gains.

US Economy: The Laborless Expansion

We forecast the US to deliver healthy GDP growth of around 3.0% in 2026. This is consistent with a robust third quarter reading of 4.3% and an estimate of 2.7% for the fourth quarter issued by the Atlanta Fed (as of January 5). The major support for this expansion will be steady consumer spending and upside may come from AI-driven capital expenditures. As we stated in our recent piece, Deep Dive: The US Consumer, the US consumer is an uneven pillar of haves and have-nots. Strong aggregate spending data masks a “K-shaped” reality, with wealthy households flourishing while financially stressed cohorts become even more constrained. The gap between these two groups may become even more exacerbated in 2026 as structurally higher inflation from tariffs, wage growth, immigration policy, and insurance cost dynamics take hold.

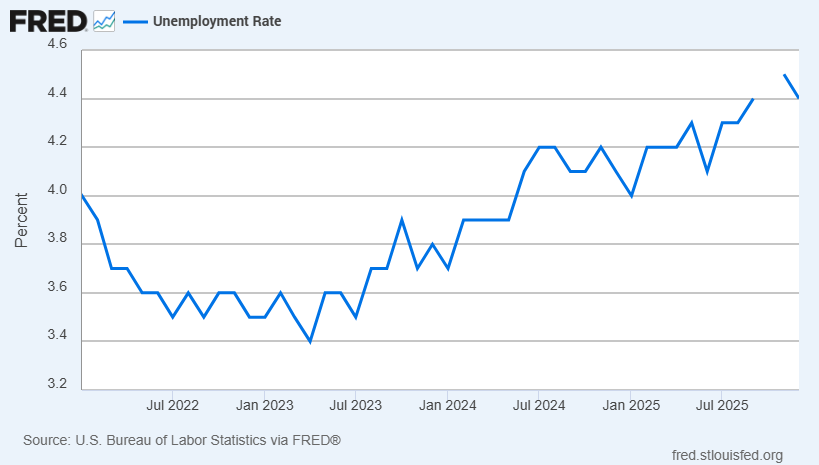

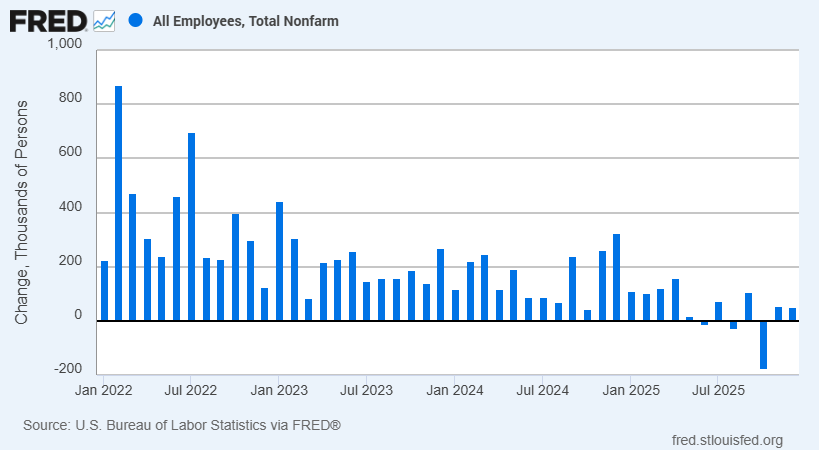

A curious feature of the current economic expansion is that it is driven by investment and consumption, even while hiring has been weak.

While storm clouds are gathering over the labor market, firm economic growth should keep the unemployment rate from rising much above 5.0%. Key support to stability in the all-important job market will be provided by Washington in the form of huge fiscal stimulus – lower tax rates and increased defense spending – and a monetary boost from the Federal Reserve. We are monitoring closely high frequency data such as jobless claims and announced layoffs to ensure that the current low hiring trend does not snowball into a late-cycle slowdown. On the other hand, we do not dismiss the possibility of a strengthening labor market next year.

US Stock Market: Earnings and Liquidity Drive Optimism

US equity markets enter 2026 with meaningful support from three sources: solid economic momentum, strong profit growth of 15.0%, and lower interest rates. We expect market leadership to remain concentrated in the companies and industries exhibiting the most earnings power, particularly those tied to the AI Supercycle. The superior returns of growth over value will likely continue. Another feature of this multi-year market rally has been the outperformance of large-cap stocks versus their smaller corporate counterparts. In 2025, the S&P MidCap 400 and S&P SmallCap 600 provided modest mid-single-digit advances, less than half of the S&P 500 return. The largest companies are clearly benefiting the most from the current financial situation. This market concentration raises the importance of valuation discipline, since the most crowded winners will also be the most sensitive to any slowdown in capital spending or other negative surprises.

A pro-growth Federal Reserve lowering interest rates provides a powerful support for extending the current three-year bull market. A reduction in bond yields this year will stimulate corporate borrowing and consumer spending, particularly the beleaguered housing industry. We expect this measured easing cycle to persist as long as hiring is weak and inflation holds near current levels. We view the May leadership transition at the Fed as a meaningful event that could impact investor confidence and market volatility. Accordingly, the latest attempts to politicize the Federal Reserve and impact policy decisions reduce confidence in Fed independence, which is harmful to the market. Overall, we are constructive, but selective: we want exposure where earnings are compounding, while staying alert to the risk that elevated multiples leave less room for error.

International Economies and Stock Markets: Can International Leadership Persist?

International stock market indexes delivered a standout year in 2025, with developed and emerging markets outperforming US stocks by a wide margin, helped by easier monetary policy, lower valuations, and a weak US dollar that lifted foreign returns for dollar-based investors. The key question for 2026 is whether those same forces remain in place. Our base case is for the dollar to trade in a steady range of plus or minus 5.0% from current levels, which would be less of a tailwind than last year. Europe should continue to grind forward with modest growth and stable inflation dynamics, aided by fiscal support and a European Central Bank that can maintain relatively low interest rates. China GDP is set to slow to 4.5% from 5.0%, but stimulus is coming. Anticipated Reserve Requirement Ratio (RRR) cuts for banks should boost domestic demand, and reforms aimed at curbing excess competition and restoring pricing power should instill confidence in their corporate sector. India remains a structural bright spot and looks like it may surpass Japan as the world’s fourth largest economy in 2026. Overall, we remain constructive on international equities, with the view that the valuation and policy backdrop can keep performance competitive even if currency effects are less impactful this year.

Bonds: Lower Short-term Yields

Fixed income enters 2026 in a familiar tension: the Federal Reserve’s rate cuts should continue to pull down short-term yields and reduce money market returns, but heavy deficit spending and elevated Treasury issuance keep upward pressure on longer-term rates. In our view, this creates a more favorable setup in short- to intermediate-maturity, high-quality bonds, where investors can still earn solid income without taking unnecessary duration risk. Credit markets remain calm, with corporate bond spreads still tight, which suggests investors are not being adequately compensated for reaching too far down the credit spectrum. As cash yields drift lower over the year, we expect more investors to look for alternatives, which should increase demand for stocks and bonds. What would change our stance is a meaningful shift in the growth or inflation trajectory: a sharp slowdown would likely push long-term yields lower, while renewed inflation pressure could drive them higher and increase volatility in longer-duration bonds.